As of February 2019, a new law for independent workers is in force, which modifies the norms of compulsory incorporation to the social security for workers who issue professional services invoices, establishing a gradual mechanism for the payment of contributions and access to pension and health benefits. This law has been in force since February 2, 2019, materializing in the Income Tax Declaration process in April of this year.

Under this new regulation, those workers who issue professional services invoices that meet the following conditions will be obliged to contribute:

- The total amount of their professional services invoices issued during the calendar year is greater than 5 minimum monthly incomes (amount close to $1,400,000).

- Are under 55 years of age, if male, and under 50 years of age, if female, as of January 1, 2018.

- Are not members of the old pension system.

In view of the aforementioned, those individuals who do not comply with said requirements, who already contribute for the taxable cap or who are pensioned for old age or total disability will not be obliged to contribute.

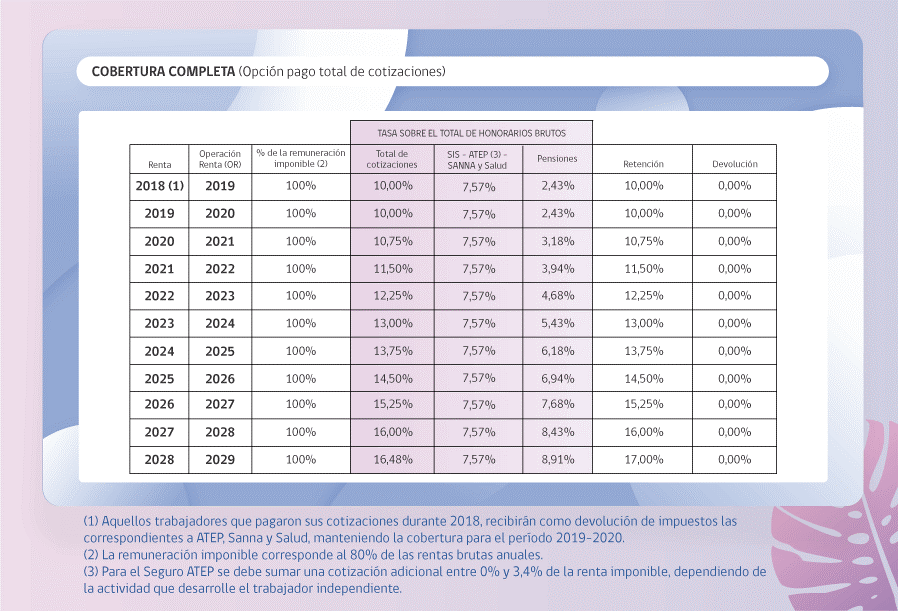

Self-employed workers will pay their social security contributions in the Income Tax Declaration process, with a charge to the tax withholdings from the fees, granting them the right to annual coverage of the different social security systems. Thus, the obligation will begin in the 2019 Annual Tax Return for 2018 income, covering the period from July 2019 to June 2020.

The benefits of incorporation into the social security system for the self-employed are as follows:

- Disability and Survivorship Insurance (SIS): disability and survivor’s pensions, death quota.

- Occupational Accident and Illness Insurance (ATEP): free medical care, rehabilitation, order of rest (medical leave and disability benefits), indemnities, disability and survivor’s pensions, death allowance.

- Health: medical attention (ambulatory and hospital), medical leave, work incapacity subsidies, prenatal subsidy, parental postnatal.

- SANNA Law: medical leave and subsidies in case of illness of a child.

- Right to family benefits: payment of family and maternity allowances to the beneficiary.

- Old-age pensions: invalidity, survivor’s and mortuary pensions.

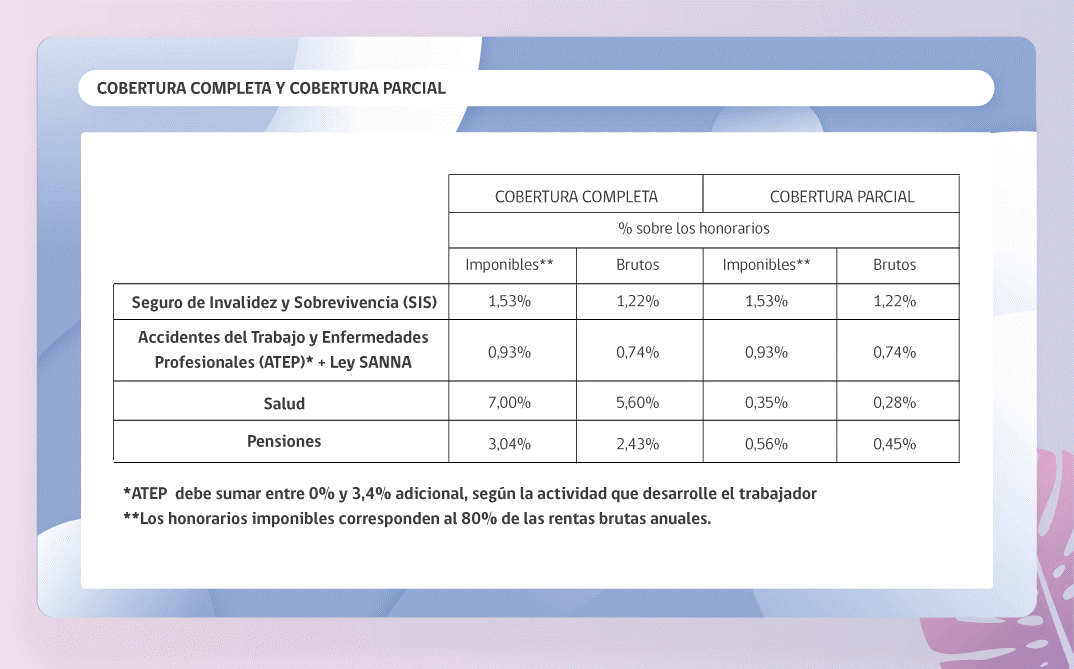

Although the law obliges workers who issue professional services invoices to contribute, it establishes two contribution options with different coverage and advantages:

- The Comprehensive Coverage system covers 100% of the employee’s social security regimes from day one, with the 10% deduction being used for contributions to all social security regimes.

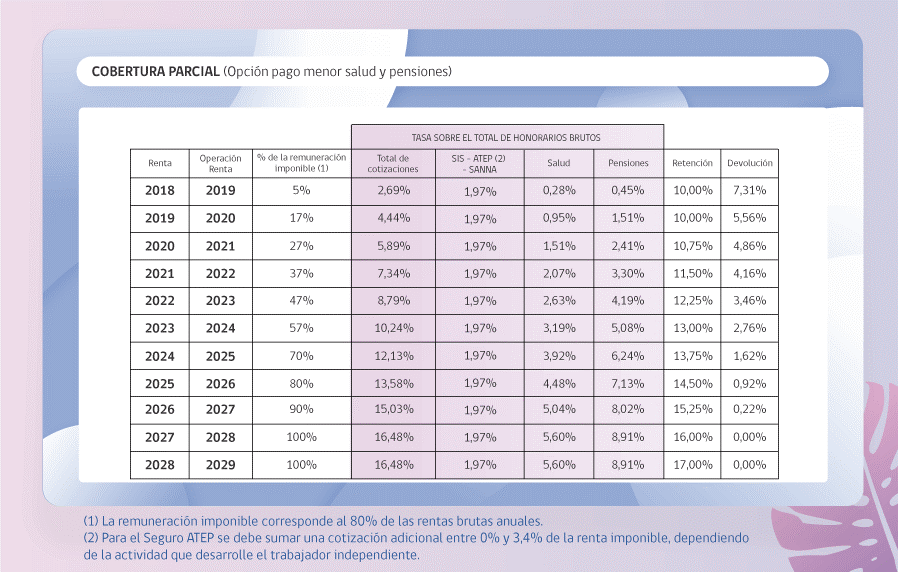

- The Partial Coverage system allows the worker to contribute for an even smaller percentage of the taxable income, starting with contributions on 5% of the taxable income in the first year, 17% in the second year, until reaching 100% in the tenth year, counted from the publication of the law; the first year of this system will be retained about 2.7% for social security payments, returning to the worker about 7.3%. The percentages will vary each year, with the amount of the refund being lower.

In both options the amount withheld will gradually increase to 17% in 2028. Each worker will be able to choose between both alternatives in each Income Tax Declaration process, being able to alternate between both options each year between 2019 and 2028.

The Taxable Base on which the contributions for the different Social Security systems will be calculated will be 80% of the Annual Gross Income of each worker, so the contribution is equivalent to 17% of the gross income of the previous calendar year. The Internal Revenue Service will determine the contributions of self-employed workers.

Those honorary workers who start issuing invoices in 2019 must make voluntary payments as self-employed workers for all social security schemes until June 2020, if they want coverage during that period.

In relation to the AFP contribution, the percentage of the deduction that will go to AFP will depend on the system that each worker chooses, whereas in the Comprehensive Coverage system in 2019 3.04% of the deduction will go to the pension fund. Under the Partial Coverage regime, 0.56% of the amount withheld will be allocated to pensions during the same period. This is due to the fact that contributions for AFP remain in the last place in the order of payment of the pension systems.

Article written by Matias Conejero, attorney from Vivir en Chile.